Understanding the Significance of Government Funding

Government funding plays a crucial role in shaping the trajectory of space exploration and technological advancement. It provides the necessary resources for long-term research projects, from developing innovative spacecraft and instruments to establishing robust infrastructure for space-based operations. This support enables scientists and engineers to push boundaries and make discoveries that may not be feasible with solely private sector investment.

Without substantial government backing, many crucial space programs might falter or even cease to exist. The sustained commitment of governments to space exploration reflects a recognition of its strategic importance, not only for scientific advancement but also for technological development and national security.

The Impact of Funding on Space Exploration Initiatives

Government funding directly impacts the scope and ambition of space exploration missions. Larger budgets allow for more complex missions, employing advanced technologies and enabling the exploration of further reaches of the solar system. This includes funding for rover missions, satellite deployments, and the development of new propulsion systems.

This investment in cutting-edge technologies often leads to spin-offs and innovations that benefit terrestrial industries, creating new jobs and driving economic growth. The development of materials for extreme environments, for example, often finds applications in other sectors.

Government Funding and Technological Advancements in Space

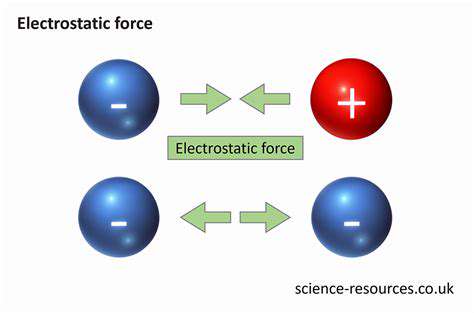

Government funding is the bedrock upon which many critical advancements in space technology are built. Support for research and development (R&D) in areas like propulsion, materials science, and communication systems is vital for pushing the boundaries of what's possible. From creating more efficient rocket designs to developing advanced satellite communication technologies, government funding fuels innovation.

Government Funding and Space Policy Development

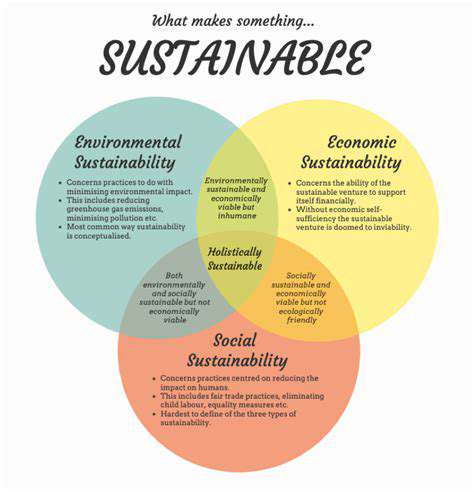

Government funding not only supports space exploration but also underpins the development and implementation of effective space policy. Policies concerning space debris mitigation, international cooperation, and the responsible use of space resources are often shaped by the availability of financial resources. These policies are essential for ensuring a sustainable and peaceful future in space.

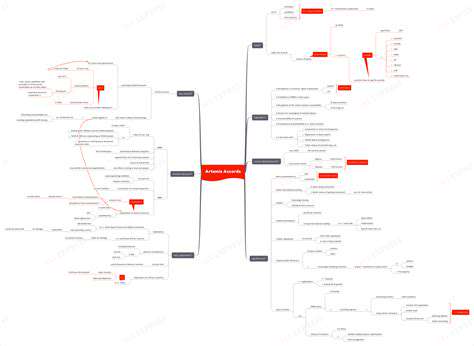

The Role of International Cooperation in Space Funding

International collaborations play a vital role in space exploration and are often facilitated by shared government funding. Pooling resources allows for larger-scale projects, such as the construction of international space stations, and fosters knowledge exchange between different nations. This cooperation fosters a shared understanding of the challenges and opportunities in space, leading to more effective and comprehensive solutions.

Funding Allocation and Prioritization in Space Programs

The allocation of government funding for space programs requires careful consideration and prioritization. Different missions and research areas compete for funding, necessitating a strategic approach to resource allocation. Decision-makers must weigh the potential scientific returns, technological advancements, and broader societal benefits of various projects when allocating budgets. This strategic prioritization ensures that investments are aligned with national goals and priorities.

Maintaining Public Support for Space Funding

Public support for government funding of space programs is crucial for long-term sustainability. Educating the public about the benefits of space exploration, including scientific discoveries, technological advancements, and economic opportunities, is vital. Communicating the impact of these investments and showcasing the tangible results of space-related endeavors can help maintain and grow public support.

Funding Models and Incentives for Innovation

Funding Models for Startups

Startups often face significant hurdles in securing initial funding, and the choice of funding model can significantly impact their trajectory. Different funding models cater to various stages of growth and needs, from bootstrapping and personal investment to venture capital and angel investors. Each model presents unique advantages and disadvantages, influencing the level of control founders retain and the potential for future returns.

Bootstrapping, relying on personal savings or revenue generated from initial operations, allows for complete control and avoids external influence. However, it typically limits growth potential and requires significant self-discipline and resilience.

Incentives for Early-Stage Investors

Early-stage investors often require compelling incentives to participate in the funding rounds of startups. These incentives can range from equity stakes to preferred returns, reflecting the higher risk associated with nascent ventures. Understanding the specific needs and motivations of these investors is crucial for attracting them and building a strong foundation for future growth.

Incentivizing angel investors, for example, might involve promising a larger equity stake in exchange for their initial capital or a faster exit strategy for their investments.

Government Funding and Grants

Government funding and grants play a vital role in supporting innovation and entrepreneurship. These programs offer a valuable pathway for startups, particularly those addressing societal challenges or leveraging cutting-edge technologies. Navigating the application process and eligibility criteria is essential for startups to maximize their chances of securing these resources.

Grants often come with specific conditions and reporting requirements, which must be carefully considered and adhered to by the recipient.

Venture Capital Funding

Venture capital (VC) firms provide significant funding to startups, typically at later stages of development, often with an expectation of substantial returns. VC funding often comes with valuable mentorship and network access, which can be crucial for scaling a business. However, VC involvement usually entails a dilution of founders' ownership and a degree of external influence.

The specific terms of VC investments can vary significantly, requiring meticulous review and negotiation by the startup.

Crowdfunding and Peer-to-Peer Lending

Crowdfunding platforms provide a direct channel for startups to connect with potential investors and raise capital from a broad base of individuals. This model can offer greater transparency and community engagement, but success often depends on the ability of the startup to effectively communicate its vision and value proposition to a wide audience. Platforms like Kickstarter and Indiegogo utilize this model to attract funding.

Rewards and Equity Structures

Different funding models often come with varied reward structures and equity allocations. Understanding the implications of these structures is critical for startups to ensure alignment with investor interests and maintain long-term viability. The specifics of equity structures, including vesting schedules and anti-dilution provisions, are crucial for preventing future disputes.

Creating a clear and transparent equity plan is vital for both investors and founders to navigate future decisions and potential conflicts.

Debt Financing and its Implications

Debt financing, including loans and lines of credit, provides a viable alternative to equity funding. It allows startups to maintain greater control over their ownership structure but often comes with stricter repayment schedules and potentially higher interest rates. Evaluating the terms of debt financing is essential to assess the long-term financial implications for the startup.

Carefully considering the associated interest rates, repayment schedules, and collateral requirements is crucial for startups seeking debt financing.